Why is it that sales keep increasing, yet profits remain stagnant?

Many e-commerce operators face this exact dilemma. Despite boosting customer acquisition, strengthening marketing efforts, and running various promotions, net profit often falls short of expectations. Why is that?

The truth is, increasing revenue alone does not guarantee improved profitability. When hidden cost leakages go unchecked, even impressive sales numbers can result in underwhelming profits. Common culprits include poor return management, excessive ad spending, inventory mismanagement, low customer retention, and accumulating payment processing fees.

Rather than simply cutting costs, the key lies in optimizing them. Let’s explore strategies to maximize e-commerce profitability through smarter cost management.

[Series preview 👀]

① Reviewing Return Management and Overspending on Advertising

② Hidden Cost Leaks! Reviewing Inventory, Retention, and Payment Processing Fees (→ we're here now!)

3. Unsold Inventory Ties Up Cash Flow

“Are we going to have to clear out this product with heavy discounts?”

For e-commerce businesses, inventory management is not just an operational issue—it’s a critical factor that directly impacts profitability. Excess inventory not only increases storage costs but also leads to reduced margins through discount promotions, creating a harmful cycle.

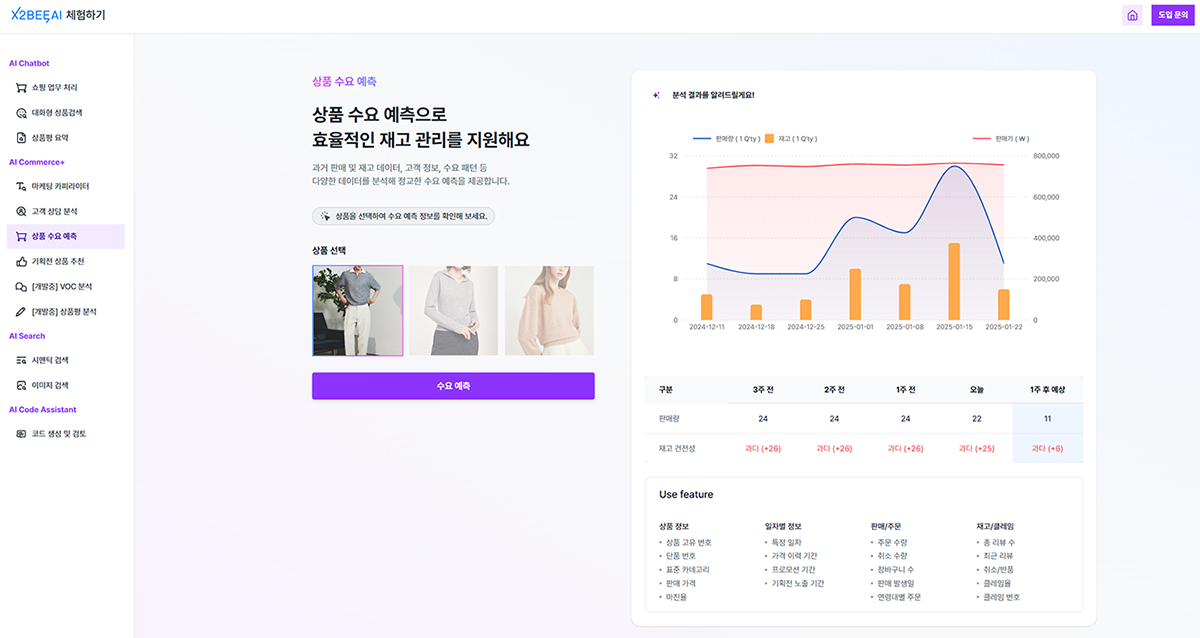

As sales channels diversify and consumer preferences become more segmented, accurate sales forecasting and efficient inventory control have become essential skills for online merchandisers.

X2BEE by PLATEER offers a demand forecasting feature that automatically sets optimal inventory levels by predicting sales trends. It delivers precise forecasts by analyzing both internal and external data, including past sales and inventory records, customer data, and demand patterns.

➡️ Curious to experience a new world of commerce powered by AI? (Click!)

4. The Pitfall of Focusing Solely on Customer Acquisition Over Retention

Many e-commerce businesses make the common mistake of focusing too heavily on acquiring new customers. According to Harvard Business Review, acquiring a new customer can cost at least five times more than retaining an existing one. Overemphasis on acquisition often leads to high marketing costs and low repurchase rates, ultimately resulting in cost leakage.

In contrast, strategies that prioritize customer lock-in and loyalty can significantly improve cost efficiency.

groobee, PLATEER’s MarTech solution, empowers e-commerce businesses to retain customers by delivering highly targeted insights based on customer behavior data. It segments users based on visit frequency and purchase history, identifies high- and low-probability buyers, analyzes behavioral patterns, and proposes strategic marketing actions accordingly.

Ultimately, chasing only new customers can become a costly trap. But by effectively retaining existing ones, businesses can reduce marketing spend and secure long-term profitability. With groobee, you can systematically implement retention strategies built on customer lock-in through: ▲ Segment-based targeting ▲ Personalized messaging and communication ▲ Performance tracking and response analysis.

➡️ [Explore groobee]

5. Payment Peocessing Fees: Small Per Transaction, Big Impact Over Time

Payment processing fees may seem minor on a per-transaction basis, but over time, they can significantly impact an e-commerce business’s profitability. Key sources of cost leakage include credit card and payment gateway (PG) fees, refund and chargeback costs, as well as transaction fees charged by open marketplace platforms—especially when offering a wide range of payment options.

To manage these costs effectively, businesses should consider implementing the following strategies.

|

Strategies for Managing Payment Processing Fees

1) Compare and Negotiate with Payment Processors

: Evaluate fee structures across multiple PG providers and negotiate lower rates based on transaction volume to reduce costs.

2) Optimize Refund and Return Management

: Lower return rates and implement refund policies using store credit or loyalty points to minimize additional fees incurred during refunds.

3) Promote Debit Cards and Alternative Payment Methods

: Encourage the use of lower-fee options such as debit cards, bank transfers, and BNPL (Buy Now, Pay Later) by offering customer incentives.

4) Operate a Brand-Owned Store and Reduce Marketplace Fees

: Reduce reliance on high-fee marketplaces by operating your own branded store. Additionally, take advantage of platform promotions that help lower transaction fees.

|

Did you enjoy today’s content?

Subscribe to PLATEER’s newsletter!

Get curated insights and updates delivered straight to your inbox.

Subscribe to our newsletter